6.27.22 Advocacy Alert: Coming Soon: Your Next Cost Increase

In the next few months, prepare to receive a much higher bill for unemployment insurance (UI).

The BNP spent over a year warning state leaders that this was coming. The state failed to act, and now, the chickens are coming home to roost.

Why are rates increasing?

During the pandemic, the state saw unprecedented levels of UI usage. To finance the uptick in usage, the state took a loan from the federal government. Now, the state must pay off that debt.

UI rates are based on (1) your experience rating, a measure of how many former employees claim UI benefits, and (2) the balance of the state’s UI trust fund. The BNP successfully advocated for legislation to insulate experience ratings from pandemic-related layoffs. However, because the UI trust fund holds this liability, employers are stuck with higher UI rates to pay it off.

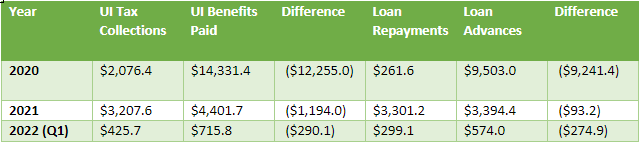

Figure 1: New York’s UI Experience During the COVID-19 Pandemic (in millions)

Source: Office of the State Comptroller

How much and for how long will rates increase?

A lot, for a while. A recent report from the State Comptroller says:

“If New York does not repay its outstanding advance by November 10, 2022, the federal UI tax rate will increase by 0.3 percent to 0.9 percent for 2022. This would represent an additional annual federal tax payment of $21 per employee; compared to 2020, the new rate would represent an increase in total tax payments of 30.5 percent for employers required to pay the highest UI tax rates and of 182.3 percent for those who currently pay the lowest rates. If New York continues to hold an outstanding balance on January 1, 2023, employers’ federal tax rate will go up to 1.2 percent, representing an additional cost of $42 per employee over current levels. This additional cost will increase by $21 per year for each employee as long as New York retains an outstanding balance on November 10 in the relevant tax year.”

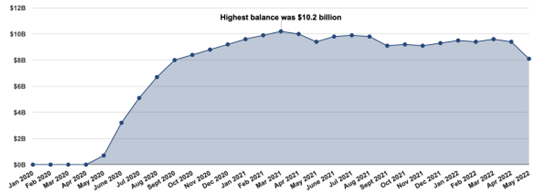

The higher rates will last many years. As Figure 2 shows, the state has barely put a dent in the debt balance. The Comptroller’s Office tells the BNP that after incurring similar debt during the Great Recession, New York did not pay off its balance until 2015 after a concerted repayment effort from Albany. Unless the state legislature acts on this issue, we can expect higher rates for the foreseeable future.

Figure 2: New York’s Unemployment Trust Fund Loan Balance

Source: Office of the State Comptroller

Can’t state leaders do anything?

Absolutely, but they have not.

Twenty one states have used their American Rescue Plan funds to either pay down their debt or replenish their UI trust funds. The BNP has called repeatedly on New York’s leaders to do so.

This ask was a prominent feature of our 2022 Advocacy Agenda. We have written and spoken to legislators and Governor Hochul numerous times about this issue.

Unfortunately, despite receiving a windfall of cash from the federal government as well as higher-than-expected tax revenue, state leaders have failed to pay off this debt or address this issue. Without action, employers will be on the hook for these costs.

The Legislature is returning to Albany for a Special Session this week. The BNP asked leadership to use this opportunity to address the UI issue.

What should employers do?

- Prepare to weather higher UI expenses. Do not be caught off guard by rate increases. Preparing your budget now can help soften the blow once the bill arrives.

- Contact state lawmakers. The BNP has a one-click tool to help you connect with New York’s leaders on this issue. Use the tool here.

- Communicate with the BNP. We want to hear your stories so that we can share them with local leaders. When your UI bill arrives, email JVeronica@thepartnership.org to let us know how much your rates and expenses increased.

Related Posts

9.6.23 Advocacy Alert: Preparing for Pay Transparency

Blog Back to Our Blog Blog Categories This month, a new law regarding pay transparency will take effect in New York. All employers should prepare to comply with this law. Get answers to frequently asked questions below. What does the law require? The law requires employers to disclose the compensation (salary or wage) or range of compensation…

Advocacy Alert: State Legislature Ends Session

The New York State Legislature gaveled out for the final time of the 2023 legislative session. Although a special session is possible before the end of the year, no major legislative push is expected.

Although much of the most impactful legislation being debated was tabled until next year, many important bills were passed in the waning days of session.

Advocacy Alert: End of Session: What We’re Watching

All eyes are on Albany as the Legislature enters the final two weeks of the 2023 legislative session. Amid the hundreds of bills that will pass in the coming days, the BNP is keeping an eye on the following issues:

Advocacy Alert: NYS Budget

State lawmakers recently approved the 2023 state budget. In total, the budget will spend $229 billion – a record amount and a 33% increase in spending since 2019.