6.27.22 Advocacy Alert: Coming Soon: Your Next Cost Increase

In the next few months, prepare to receive a much higher bill for unemployment insurance (UI).

The BNP spent over a year warning state leaders that this was coming. The state failed to act, and now, the chickens are coming home to roost.

Why are rates increasing?

During the pandemic, the state saw unprecedented levels of UI usage. To finance the uptick in usage, the state took a loan from the federal government. Now, the state must pay off that debt.

UI rates are based on (1) your experience rating, a measure of how many former employees claim UI benefits, and (2) the balance of the state’s UI trust fund. The BNP successfully advocated for legislation to insulate experience ratings from pandemic-related layoffs. However, because the UI trust fund holds this liability, employers are stuck with higher UI rates to pay it off.

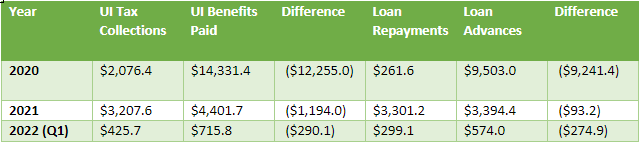

Figure 1: New York’s UI Experience During the COVID-19 Pandemic (in millions)

Source: Office of the State Comptroller

How much and for how long will rates increase?

A lot, for a while. A recent report from the State Comptroller says:

“If New York does not repay its outstanding advance by November 10, 2022, the federal UI tax rate will increase by 0.3 percent to 0.9 percent for 2022. This would represent an additional annual federal tax payment of $21 per employee; compared to 2020, the new rate would represent an increase in total tax payments of 30.5 percent for employers required to pay the highest UI tax rates and of 182.3 percent for those who currently pay the lowest rates. If New York continues to hold an outstanding balance on January 1, 2023, employers’ federal tax rate will go up to 1.2 percent, representing an additional cost of $42 per employee over current levels. This additional cost will increase by $21 per year for each employee as long as New York retains an outstanding balance on November 10 in the relevant tax year.”

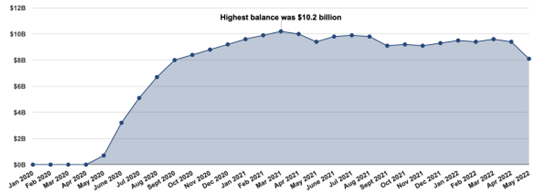

The higher rates will last many years. As Figure 2 shows, the state has barely put a dent in the debt balance. The Comptroller’s Office tells the BNP that after incurring similar debt during the Great Recession, New York did not pay off its balance until 2015 after a concerted repayment effort from Albany. Unless the state legislature acts on this issue, we can expect higher rates for the foreseeable future.

Figure 2: New York’s Unemployment Trust Fund Loan Balance

Source: Office of the State Comptroller

Can’t state leaders do anything?

Absolutely, but they have not.

Twenty one states have used their American Rescue Plan funds to either pay down their debt or replenish their UI trust funds. The BNP has called repeatedly on New York’s leaders to do so.

This ask was a prominent feature of our 2022 Advocacy Agenda. We have written and spoken to legislators and Governor Hochul numerous times about this issue.

Unfortunately, despite receiving a windfall of cash from the federal government as well as higher-than-expected tax revenue, state leaders have failed to pay off this debt or address this issue. Without action, employers will be on the hook for these costs.

The Legislature is returning to Albany for a Special Session this week. The BNP asked leadership to use this opportunity to address the UI issue.

What should employers do?

- Prepare to weather higher UI expenses. Do not be caught off guard by rate increases. Preparing your budget now can help soften the blow once the bill arrives.

- Contact state lawmakers. The BNP has a one-click tool to help you connect with New York’s leaders on this issue. Use the tool here.

- Communicate with the BNP. We want to hear your stories so that we can share them with local leaders. When your UI bill arrives, email JVeronica@thepartnership.org to let us know how much your rates and expenses increased.

Related Posts

9.26.22 Advocacy Alert: Canada to Remove All Border Restrictions

The Public Health Agency of Canada announced it will lift all COVID-related restrictions on international travelers beginning this Saturday, October 1.

BNP Advocacy Insider – September 2022

Our Monthly Members-Only recap of the latest Advocacy, and Government news.

8.24.22 Advocacy Alert: Primary #2 Wrap-Up

Late last night, elections officials tallied results for primary and special elections.

8.18.21 Advocacy Alert: Primary Day #2 Next Week

On Tuesday, August 23, voters will head to the polls for a second round of primary elections.

In June, voters selected primary nominees for Governor and Erie County Clerk. Because the State Legislature’s redistricting maps were thrown out in court, however, primaries for Congressional and State Senate races were moved to August.